Looking back at the year 2020, the business performance of optical communication manufacturers is like riding on a roller coaster, roaring on the rail all the way to the bottom of the valley, and then difficult to climb the hill, interpretation is thrilling.It is not gravity, but the operating environment, that dominates the drama.Affected by the outbreak of COVID - 19, optical communication manufacturer in the first quarter of 2020 mostly appeared the situation of operating income, net profit fell sharply, then in the second quarter in new infrastructure, such as operators in good policy, performance improvements, and to keep the momentum to the third quarter and fourth quarter, helping a lot of enterprise profit.However, according to the data provided by CRU, Lightcounting and other well-known research institutions at home and abroad, the overall performance of major optical communication products such as optical fiber cable and optical devices is still relatively low due to the influence of COVID-19 epidemic spreading around the world.To this end, CRU predicts that global cable consumption will decline by 2.3% in 2020 from a year earlier and not exceed the 2019 level until 2022.LightCounting, on the other hand, has lowered its market expectations for optical modules across the board, expecting global ISPs to resume infrastructure deployments by the end of 2021 and accelerate the pace in 2020-2025.Despite the slow growth in global demand for optical fibers and cables due to the COVID-19 epidemic, with large-scale FTTH construction basically completed, 5G network deployment will become a major driving force for the future growth of optical fiber and cable consumption.More than 600,000 5G base stations will be built in 2021, said Xiao Yaqing, minister of the Ministry of Industry and Information Technology, at a meeting on 2021 national industry and information technology.

To this end, CRU remains optimistic about the prospect of 5G-related consumption in China.Michael Finch, head of CRU's cable division, said the big three telecom operators' 5G capital spending in 2020 is up 338% from 2019.This trend is set to continue in 2021 as telecom operators increasingly focus on large-scale 5G rollouts and help cement their leading position in 5G.Based on these forecasts, CRU believes that China's consumption of fiber optic cables will increase by 4-5% in 2021, with a slight contraction in consumption in 2020.Taking a global view, given the higher fiber volumes and associated new infrastructure required for 5G SA construction, Finch believes that 5G will have a more profound impact on global fiber optic cable consumption starting in 2021. CRU expects that by 2021, with the COVID-19 epidemic under control and the global economy returning to normal, operators' fixed-line, 5G construction will be on track.Global demand for fiber optic cables is expected to grow by 7%.At the same time, driven by the ubiquitous fiber optic network, the demand for fiber optic cables will maintain a relatively stable growth in the next few years.Of this, mobile infrastructure and rail infrastructure alone will require nearly 200 million wirekms of fiber and cable, which will grow to 300 million wirekms by 2024, representing a CAGR of about 14.5%.However, it should be noted that since 2017, driven by a surge in prefabricated rod investment and capacity expansion, and a contraction in global cable consumption since 2018, the global excess capacity of prefabricated fiber rods has been further exacerbated, leading to a sustained decline in the price of fiber optic cables.Finch said that while the situation was first seen in China, where domestic producers quickly increased exports to maintain high capacity levels at home, weak prices have rippled through global markets.To that end, CRRU expects prices to remain under pressure in the medium term unless overcapacity is resolved and meaningful rationalisation of supply takes place.The COVID-19 epidemic has put many companies under pressure in 2020 due to lower revenue, resulting in lower spending on Internet bandwidth and traffic, which has a direct impact on ISPs' revenue.To that end, Lightcounting notes in its report that Ciena, Cisco, and Intel have all slashed their sales forecasts for enterprise and telecom customers.ISPs will continue to build on existing systems, but the number of new projects will fall sharply.Nevertheless, some foreign experts still predict that the world economic growth is likely to return to the pre-epidemic level in 2021.Therefore, Lightcounting predicts that ISPs around the world will resume information infrastructure construction by the end of 2021 at the latest, thus driving global optical module demand growth and returning to accelerated growth from 2022.

In China, in 2020, many optical module manufacturers will release various new products such as wavelength division multiplexing (DWDM/CWDM) optical modules and 400G high-speed Ethernet optical modules.As new infrastructure continues to accelerate in 2021, the demand for optical modules in China will grow rapidly, but the price of optical module collection will likely remain low.Compared with China, the pace of 5G deployment in Europe and the United States will slow down, which will affect the demand for 5G pretransfer and backtransmit optical module products.Not only such, alibaba, amazon and other relatively small number of cloud computing service is a major consumer of Ethernet optical module, in the face of a large number of light module a firm possesses stronger bargaining power, while the demand for light module is proportional to the data center construction scale, but in the fierce market competition, Ethernet optical module prices will continue to decline.Due to the above reasons, Lightcounting has lowered the market expectation of all kinds of optical module products except optical interconnection plate while predicting the recovery and growth of optical module demand scale. In particular, the prediction of FTTX, 5G pretransfer and back-transfer products has been lowered by 15% ~ 30%.Optical transmission network fast forward 400G, from the G.654.E fiber through the current network test to the 400G silicon optical module release, from the 400G core switch commercial to the 400G MAN deployment, the global 400G system is expected to become the optical transmission network market mainstream application in 2 ~ 3 years.China Mobile Research Institute professor-level senior engineer Li Yunbo predicted that, from the perspective of the backbone network level, single wave 400G is about to open, and enter a long period.According to international consultancy Omdia, the global 400G market is expected to reach nearly $4 billion in 2021, $5 billion in 2022 and $6 billion in 2023, making it a mainstream market.

A new study from the Dell 'Oro Group, an international consulting firm, confirms this.The company predicts that by the end of 2021, 400G demand will be in large numbers across all parts of the optical network.Moreover, Qiao Yan, general manager of switch product line of Xinhua 3 Group, also believes that global Ethernet will quickly enter the 400G era from 2021, and in the following five years, the related equipment, optical path and supporting ecological costs will be greatly reduced.Within the data center, there will also be companies adopting 400GB data clusters in 2021.It is clear that 400G will quickly blossom in the optical transmission network market in 2021.However, 400G is not the end of the road.It is reported that industry chain manufacturers are actively researching 800Gbps technology, developing related products and solutions, and taking the lead in Russia, Turkey and other countries to carry out current network deployment or experiment.In 2021, Dell 'Oro Group predicts that 600 Gbps capacity line cards will see rapid growth in 2021, as will shipments of 800Gbps line cards.Omdia also believes that the upgrade of the long-distance network market to 600G and 800G technologies will accelerate by 2021.From single-wave 200G to 400G systems to the future 800G and even 1T systems, the industry continues to introduce new technologies to promote the continuous expansion and upgrading of optical transmission networks.Optical communication is one of the important technological bases of new infrastructure represented by 5G and data center, and it is also one of the necessary conditions for 5G to integrate into thousands of industries.While the impact of COVID-19 continues to be felt, as new infrastructure speeds up and deepens and the ICT industry continues to recover, 2021 will be the year for the next wave of growth in the 5G era, which will continue until at least 2025.

News

News TianChang News

TianChang News TianChang News

TianChang News TianChang Information

TianChang Information TianChang Product

TianChang Product Products

Products Used for outdoor optical cable, belongs to a kind of optical cable, because the most suitable for outdoor so called outdoor optical cable, it is durable, can withstand the wind and the sun, the outer packing is thick, with pressure resistance, corrosion resistance, tensile resistance and some mechanical characteristics, environmental characteristics.

Used for outdoor optical cable, belongs to a kind of optical cable, because the most suitable for outdoor so called outdoor optical cable, it is durable, can withstand the wind and the sun, the outer packing is thick, with pressure resistance, corrosion resistance, tensile resistance and some mechanical characteristics, environmental characteristics. Used for outdoor optical cable, belongs to a kind of optical cable, because the most suitable for outdoor so called outdoor optical cable, it is durable, can withstand the wind and the sun, the outer packing is thick, with pressure resistance, corrosion resistance, tensile resistance and some mechanical characteristics, environmental characteristics.

Used for outdoor optical cable, belongs to a kind of optical cable, because the most suitable for outdoor so called outdoor optical cable, it is durable, can withstand the wind and the sun, the outer packing is thick, with pressure resistance, corrosion resistance, tensile resistance and some mechanical characteristics, environmental characteristics. Indoor optical cable is the optical cable laid in the building, mainly used for communication equipment, computers, switches and end-user equipment in the building.To get the message across.

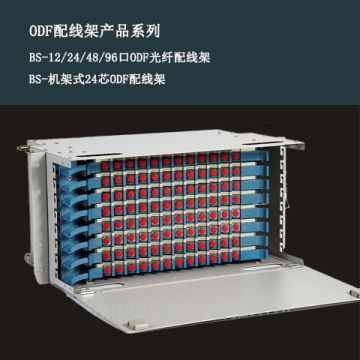

Indoor optical cable is the optical cable laid in the building, mainly used for communication equipment, computers, switches and end-user equipment in the building.To get the message across. Fiber optic distribution frame is an important supporting equipment in optical transmission system. It is used for optical fiber fusion of optical cable terminal, adjustment of optical connector, storage of excess tail fiber and protection of optical cable and other functions.

Fiber optic distribution frame is an important supporting equipment in optical transmission system. It is used for optical fiber fusion of optical cable terminal, adjustment of optical connector, storage of excess tail fiber and protection of optical cable and other functions. Cable connection box, also called cable connector box and the gun barrel, is the place where the end of the cable connection, and then through the optical fiber jumper wire connected to the light switch, prevent heat, cold in nature, light, material aging caused by oxygen and microorganism.

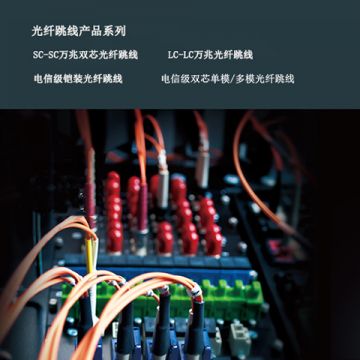

Cable connection box, also called cable connector box and the gun barrel, is the place where the end of the cable connection, and then through the optical fiber jumper wire connected to the light switch, prevent heat, cold in nature, light, material aging caused by oxygen and microorganism. Fiber optic jumpers are used for jumpers from equipment to fiber optic cabling links.It has a thick protective layer, which is generally used in the connection between optical terminal machine and terminal box. It is applied in some fields such as optical fiber communication system, optical fiber access network, optical fiber data transmission and local area network.

Fiber optic jumpers are used for jumpers from equipment to fiber optic cabling links.It has a thick protective layer, which is generally used in the connection between optical terminal machine and terminal box. It is applied in some fields such as optical fiber communication system, optical fiber access network, optical fiber data transmission and local area network. Special optical cable

Special optical cable Optical cable intelligent monitoring system

Optical cable intelligent monitoring system Solutions

Solutions Operator Case

Operator Case Operator Case

Operator Case Government and military characteristic cases

Government and military characteristic cases Airport and rail transit cases

Airport and rail transit cases High speed case

High speed case Smart City Cases

Smart City Cases Real estate, hotel cases

Real estate, hotel cases Services

Services Tiangyong communication technical solutions mainly include the solution for customers to pre-sale services and product maintenance and other basic services, so that each consumer to buy quality products and services, but consumers are often easy to be confused by some false impression, and into the "quality products" misunderstandings

Tiangyong communication technical solutions mainly include the solution for customers to pre-sale services and product maintenance and other basic services, so that each consumer to buy quality products and services, but consumers are often easy to be confused by some false impression, and into the "quality products" misunderstandings Tiangyong communication technical solutions mainly include the solution for customers to pre-sale services and product maintenance and other basic services, so that each consumer to buy quality products and services, but consumers are often easy to be confused by some false impression, and into the "quality products" misunderstandings

Tiangyong communication technical solutions mainly include the solution for customers to pre-sale services and product maintenance and other basic services, so that each consumer to buy quality products and services, but consumers are often easy to be confused by some false impression, and into the "quality products" misunderstandings We take customer satisfaction as the tenet, timely response to customer needs as the key, to provide high value services for customers as the goal, with customized customer support service solutions, to win the market and customer respect.

We take customer satisfaction as the tenet, timely response to customer needs as the key, to provide high value services for customers as the goal, with customized customer support service solutions, to win the market and customer respect. Tianchang communication channel management mainly includes channel announcements, channel policies, etc., the search of partners

Tianchang communication channel management mainly includes channel announcements, channel policies, etc., the search of partners Resources

Resources Guangzhou tianchang communication technology co., LTD is looking for a position

Guangzhou tianchang communication technology co., LTD is looking for a position Guangzhou tianchang communication technology co., LTD is looking for a position

Guangzhou tianchang communication technology co., LTD is looking for a position Employees Story

Employees Story Cultivation of Talents

Cultivation of Talents In order to make the human resource system run effectively, we undertake the company's strategy, culture and core competitiveness, constantly introduce the industry's advanced methodology and best practices, and learn from the industry and cross-border benchmarking and advanced enterprises, so as to continuously optimize the human resource system

In order to make the human resource system run effectively, we undertake the company's strategy, culture and core competitiveness, constantly introduce the industry's advanced methodology and best practices, and learn from the industry and cross-border benchmarking and advanced enterprises, so as to continuously optimize the human resource system laboratory

laboratory Laboratory Profile

Laboratory Profile Laboratory Profile

Laboratory Profile The Scientific Research Direction

The Scientific Research Direction The latest News

The latest News Open Topic

Open Topic About Us

About Us Contact Us

Contact Us Contact Us

Contact Us Telecommunications, Mobile, Unicom, Radio and Television, Power, Transportation, Military, Intelligent Building, Government, Public Security, Real Estate, Manufacturing, Education, Hospitals, Finance...

Telecommunications, Mobile, Unicom, Radio and Television, Power, Transportation, Military, Intelligent Building, Government, Public Security, Real Estate, Manufacturing, Education, Hospitals, Finance... Through the tyre certification and ISO9001 international quality system certification, and in accordance with the tyre certification and ISO9001 international quality system operation requirements, has established a set of efficient production process, perfect process guidance system and process quality continuous monitoring system.

Through the tyre certification and ISO9001 international quality system certification, and in accordance with the tyre certification and ISO9001 international quality system operation requirements, has established a set of efficient production process, perfect process guidance system and process quality continuous monitoring system. 企业定位:通信产品整体解决方案服务商。业务涵盖光缆、光缆智能监测系统的生产、销售以及提供客户所需的通信整体解决方案。 企业愿景:打造通信行业(BOSUN)国际知名品牌,成为优秀的通信解决方案提供商。 企业使命:让通信更流畅, 让沟通无障碍。 价值理念:诚信、务实、 创新、尽责。

企业定位:通信产品整体解决方案服务商。业务涵盖光缆、光缆智能监测系统的生产、销售以及提供客户所需的通信整体解决方案。 企业愿景:打造通信行业(BOSUN)国际知名品牌,成为优秀的通信解决方案提供商。 企业使命:让通信更流畅, 让沟通无障碍。 价值理念:诚信、务实、 创新、尽责。 As a core technology brand in optical communication field, BOSUN has become an excellent representative among the national "innovative enterprises". Every year, 18% of the sales revenue will be invested in R&D, of which 38% will be invested in future high-end technology R&D.Over the years, BOSUN has made steady progress on the innovation road of independent research and development, leading and promoting the rapid development of cutting-edge optical communication technology.

As a core technology brand in optical communication field, BOSUN has become an excellent representative among the national "innovative enterprises". Every year, 18% of the sales revenue will be invested in R&D, of which 38% will be invested in future high-end technology R&D.Over the years, BOSUN has made steady progress on the innovation road of independent research and development, leading and promoting the rapid development of cutting-edge optical communication technology.